Candlestick charts were originated in Japan over 100

years before the West had developed the bar charts and point-and-figure charts.

In the 1700s, a Japanese man known as Homma discovered that as there was a link

between price and the supply and demand of rice, the markets also were strongly

influenced by the emotions of traders.

A

daily candlestick charts shows the security’s open, high, low, and close price

for the day. The candlestick’s wide or rectangle part is called the “real body”

which shows the link between opening and closing prices.

This

real body shows the price range between the open and close of that day’s

trading.

When

the real body is filled, black or red then it means that the close is lower

than the open and is known as the bearish candle. It shows that the prices

opened, the bears pushed the prices down and closed lower than the opening

price.

If

the real body is empty, white or green then it means that the close was higher

than the open known as the bullish candle. It shows that the prices opened, the

bulls pushed the prices up and closed higher than the opening price.

The

thin vertical lines above and below the real body is known as the wicks or

shadows which represents the high and low prices of the trading session.

The upper shadow shows the high price and lower shadow shows

the low prices reached during the trading session.

There are 30 types of Candlestick charts, but we discussed 2 candlestick in 1 blog

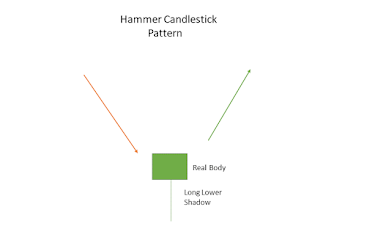

Hammer:

Hammer is single candlestick pattern which is formed at the end of a downtrend and signals bullish reversal.

The real body of this candle is small and is

located at the top with a lower shadow which should be more than twice of the

real body. This candlestick chart pattern has no or little upper shadow.

The psychology behind this candle formation

is that the prices opened and seller pushed down the prices.

Suddenly the buyers came into the market and

pushed the prices up and closed the trading session more than the opening

price.

This resulted in the formation of

bullish pattern and signifies that buyers are back in the market and downtrend

may end.

Traders can enter a long position if next day a bullish

candle is formed and can place a stop-loss at the low of Hammer.

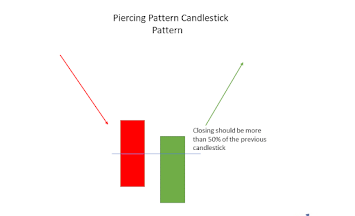

Piercing

Pattern:

Piercing pattern is multiple

candlestick chart pattern which

is formed after a downtrend indicating bullish reversal.

It is formed by two candles, the first candle being a

bearish candle which indicates the continuation of the downtrend.

The second candle is a bullish candle which opens gap

down but closes more than 50% of the real body of the previous candle which

shows that the bulls are back in the market and a bullish reversal is going to

take place.

Traders can enter a long position if next day a bullish

candle is formed and can place a stop-loss at the low of the second candle.

Happy Trading & Happy Investing

No comments:

Post a Comment